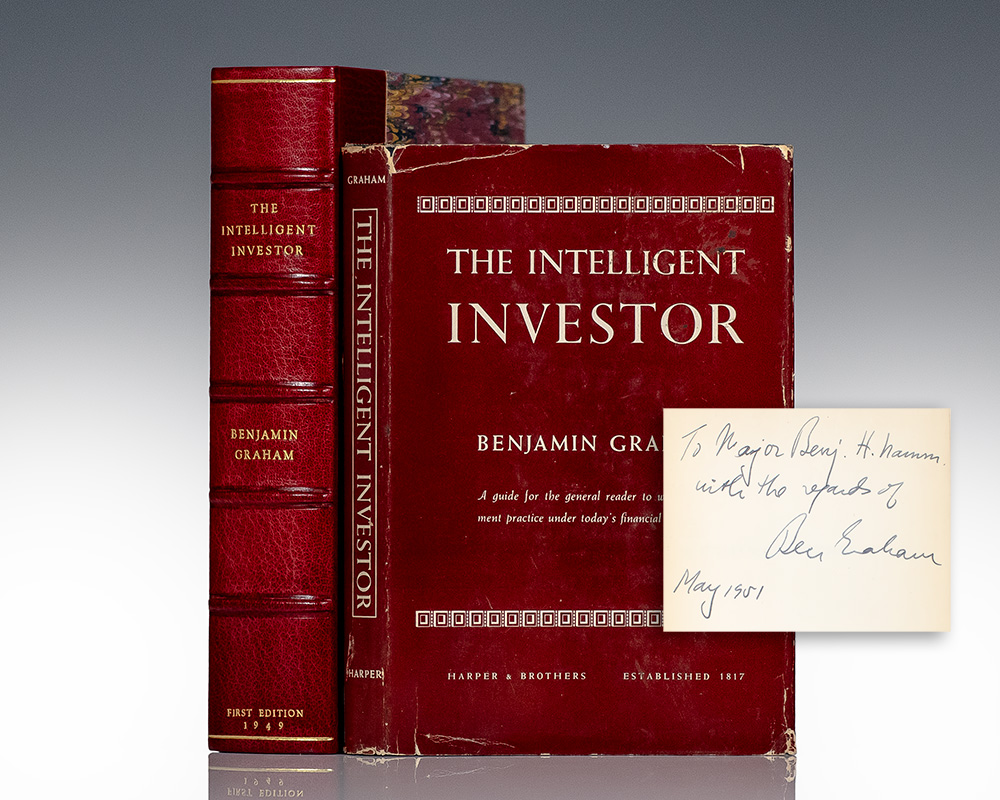

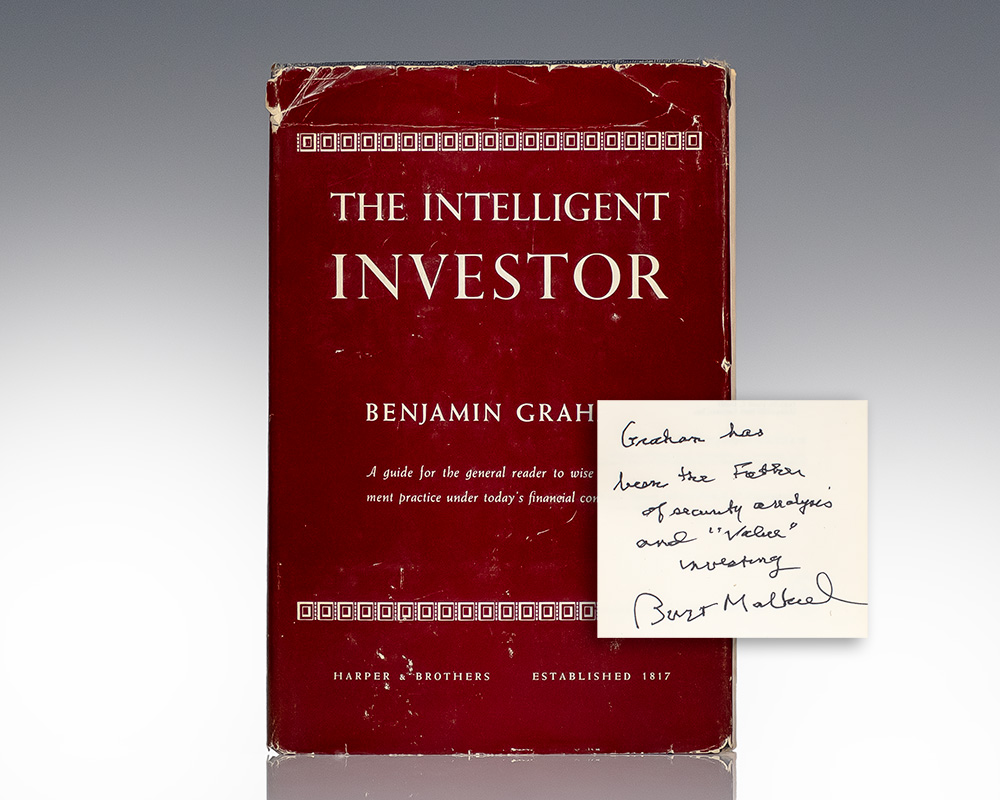

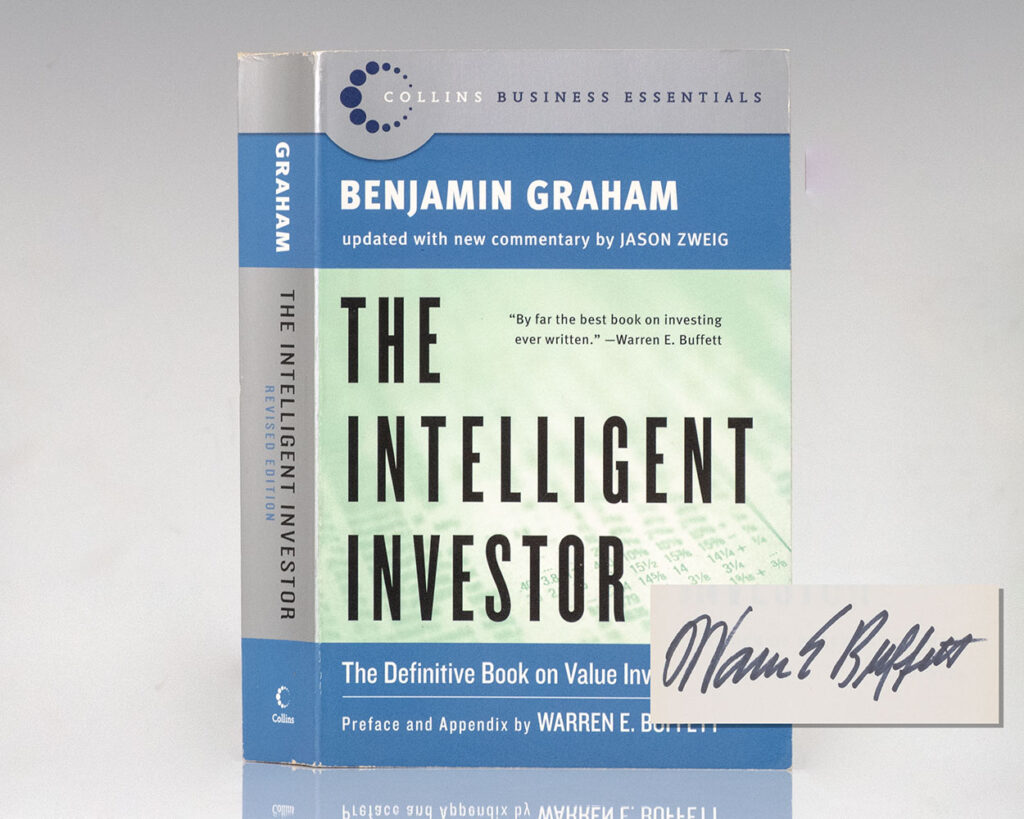

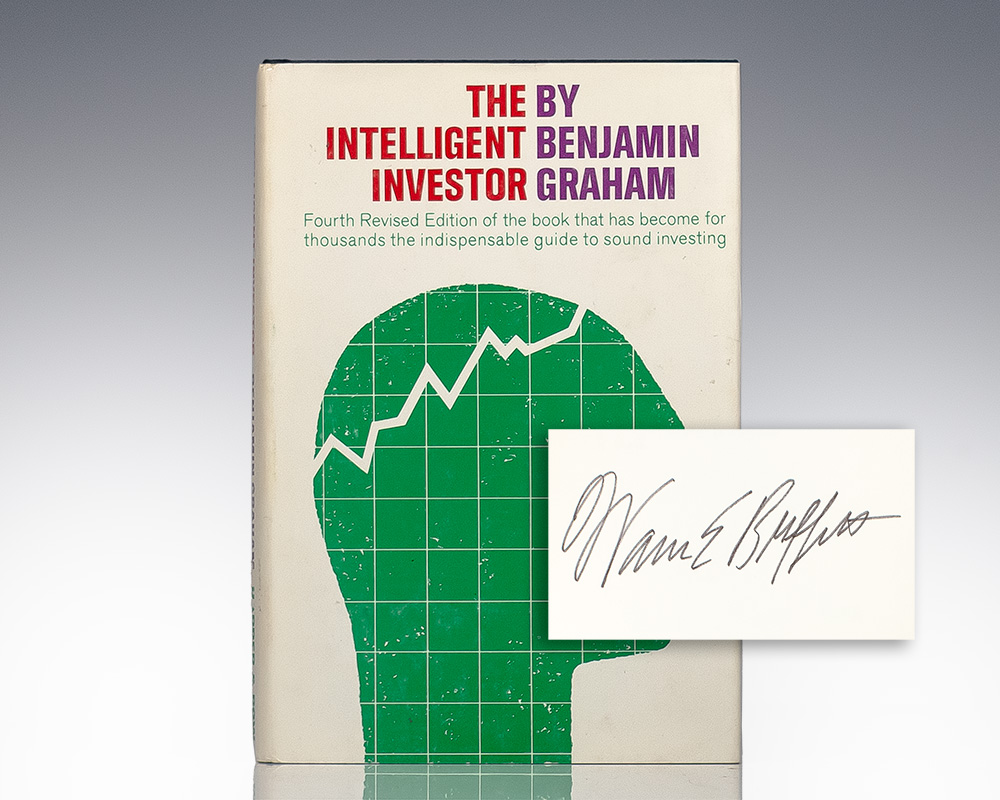

GRAHAM, Benjamin.

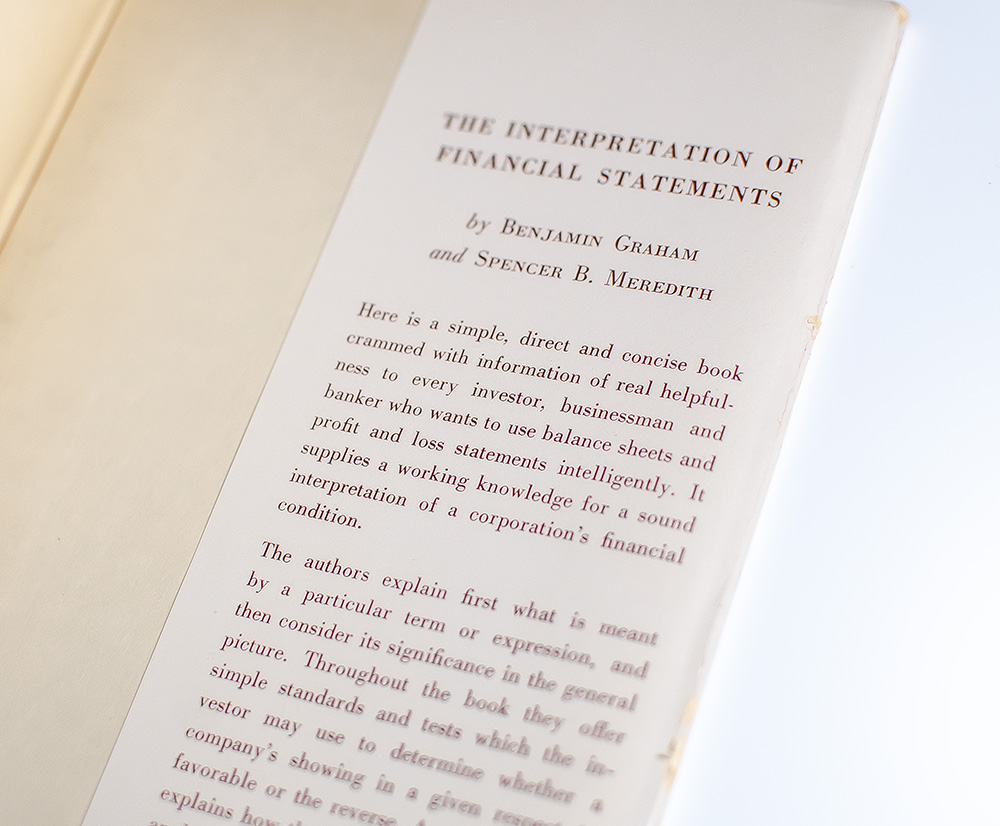

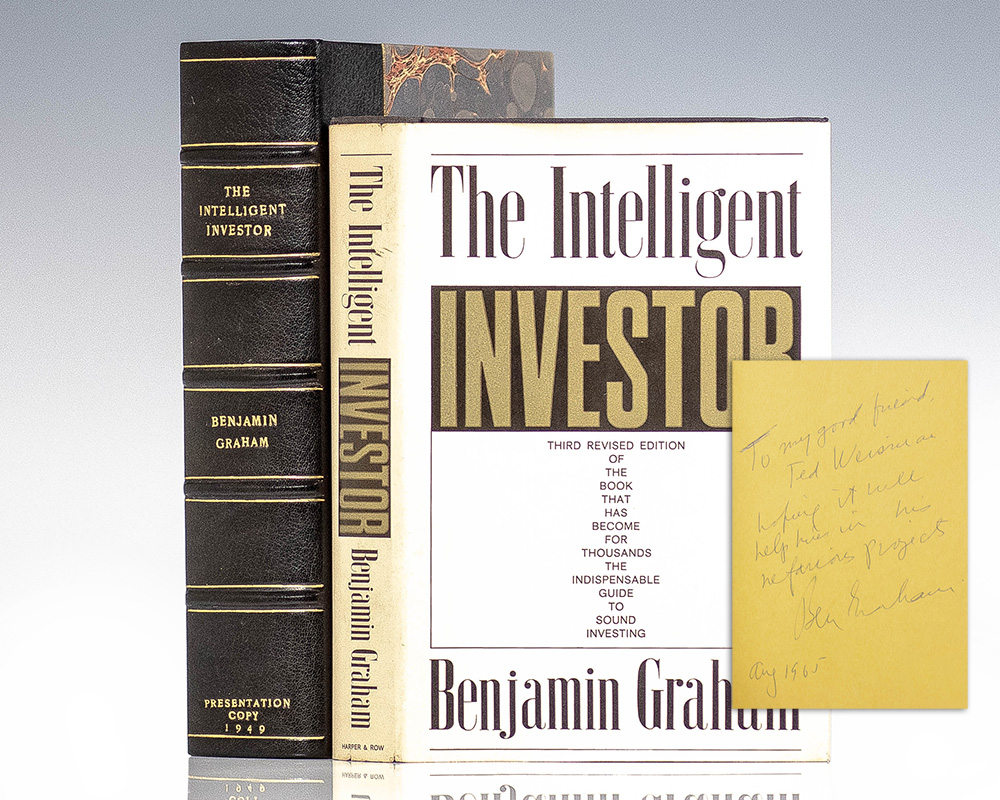

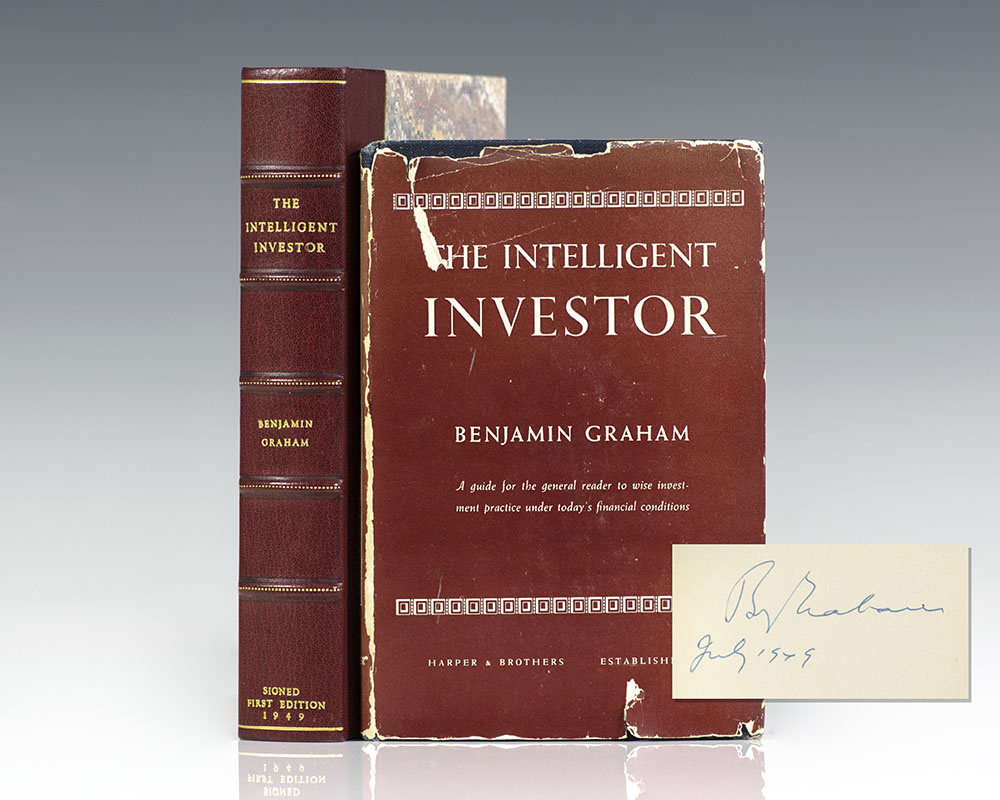

The Intelligent Investor.

"By far the best book on investing ever written" (Warren Buffett): Rare First Edition of The Intelligent Investor; Inscribed by Benjamin Graham

New York: Harper & Brothers Publishers, 1949.

$150,000.00

In Stock

Item Number: RRB-150060

* Custom Clamshell Boxes are hand made by the Harcourt Bindery upon request and take approximately 60 days to complete

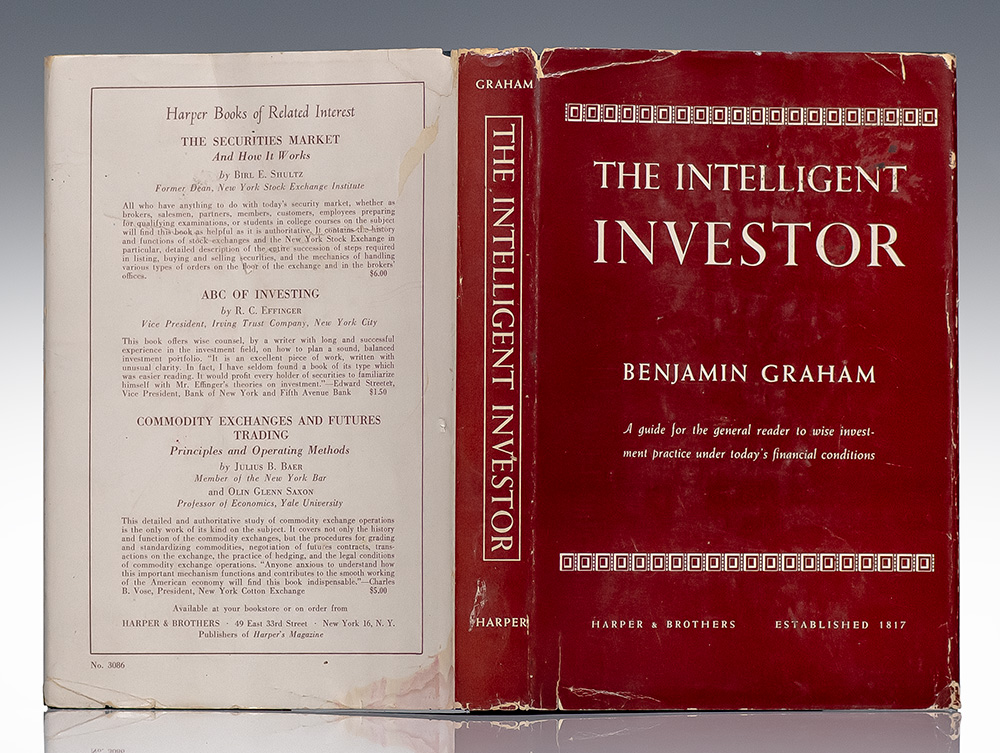

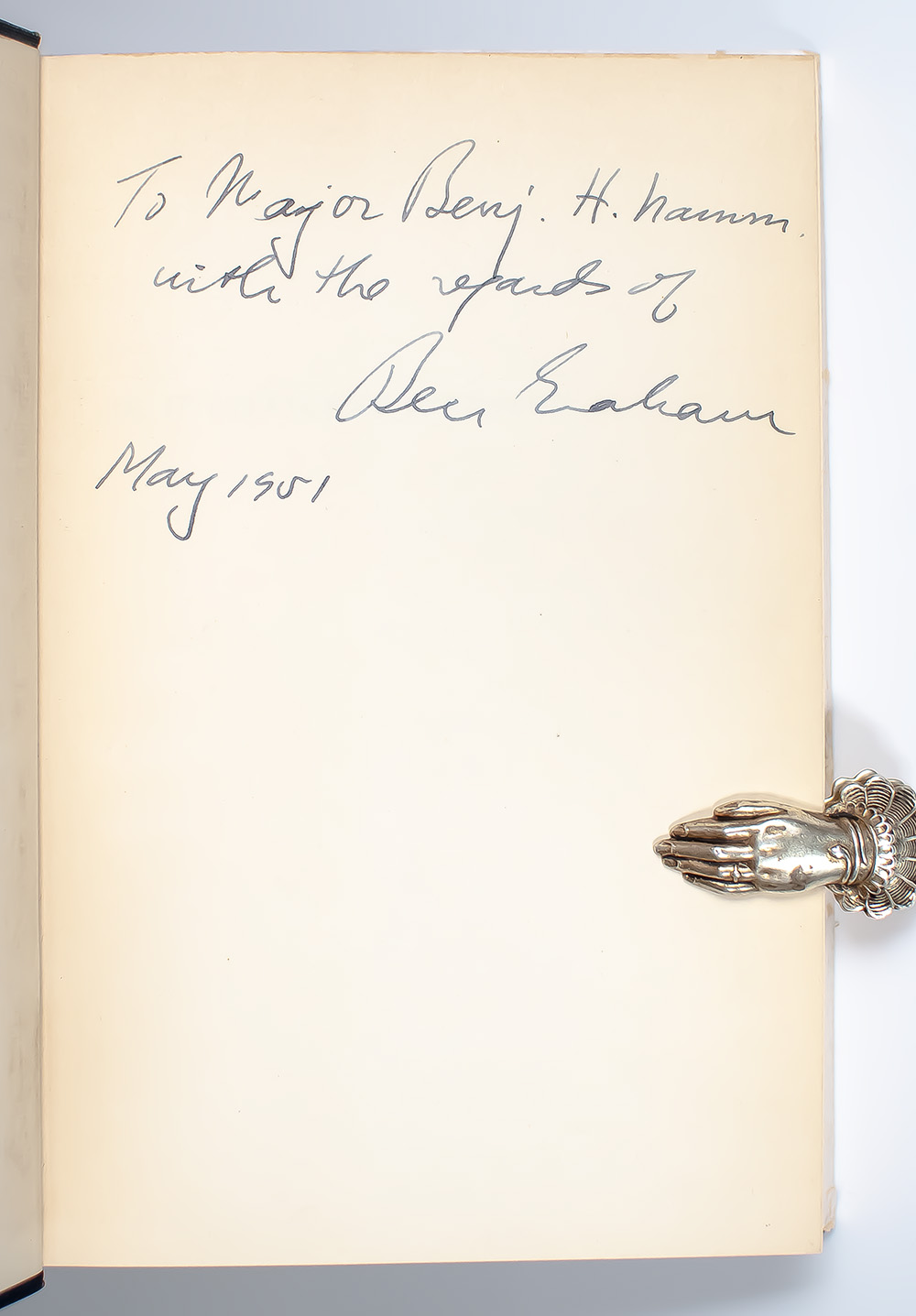

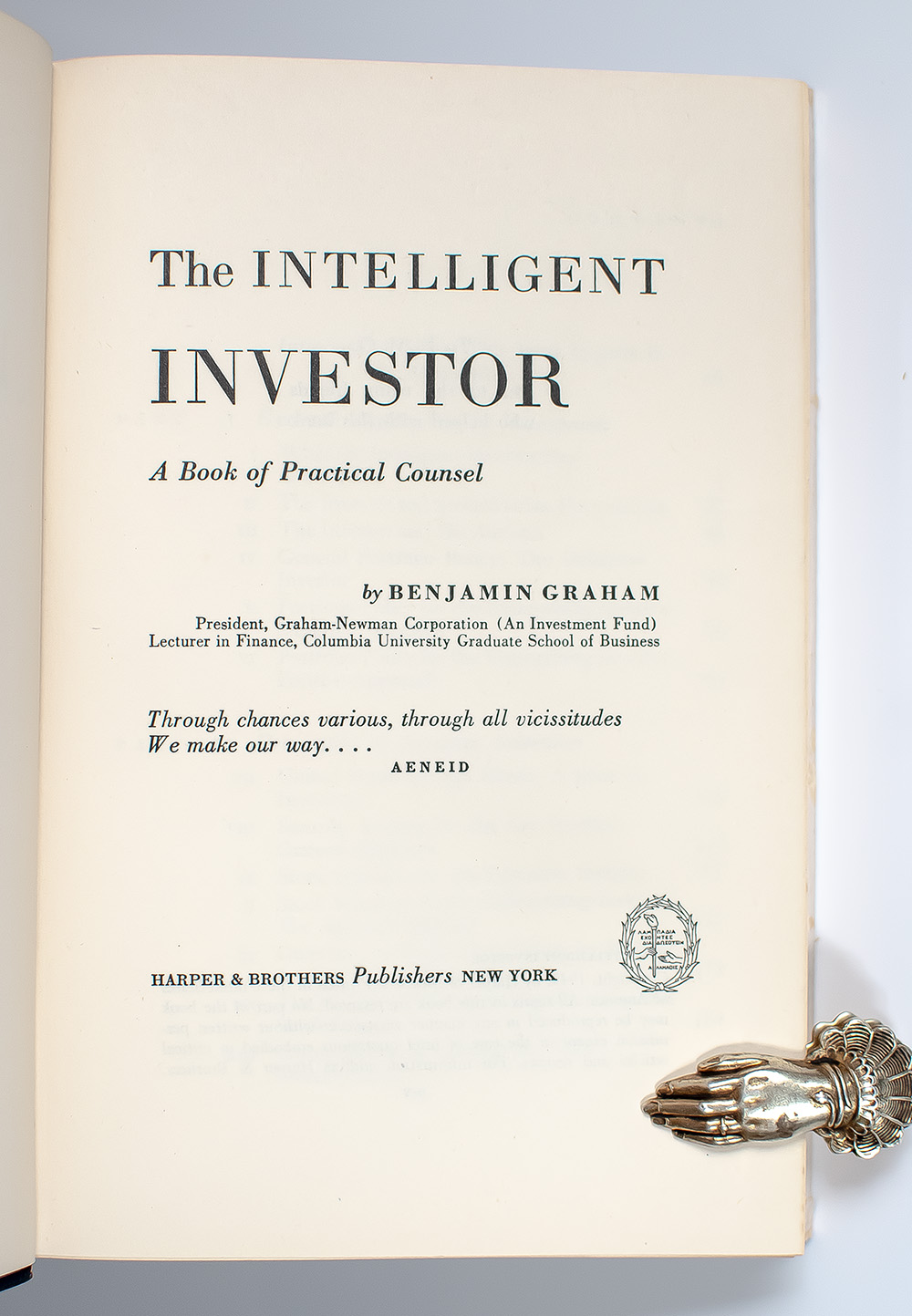

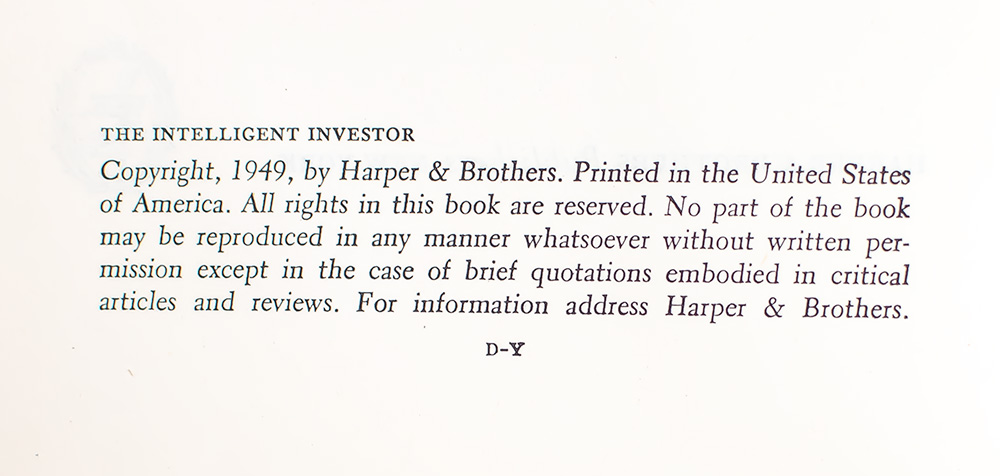

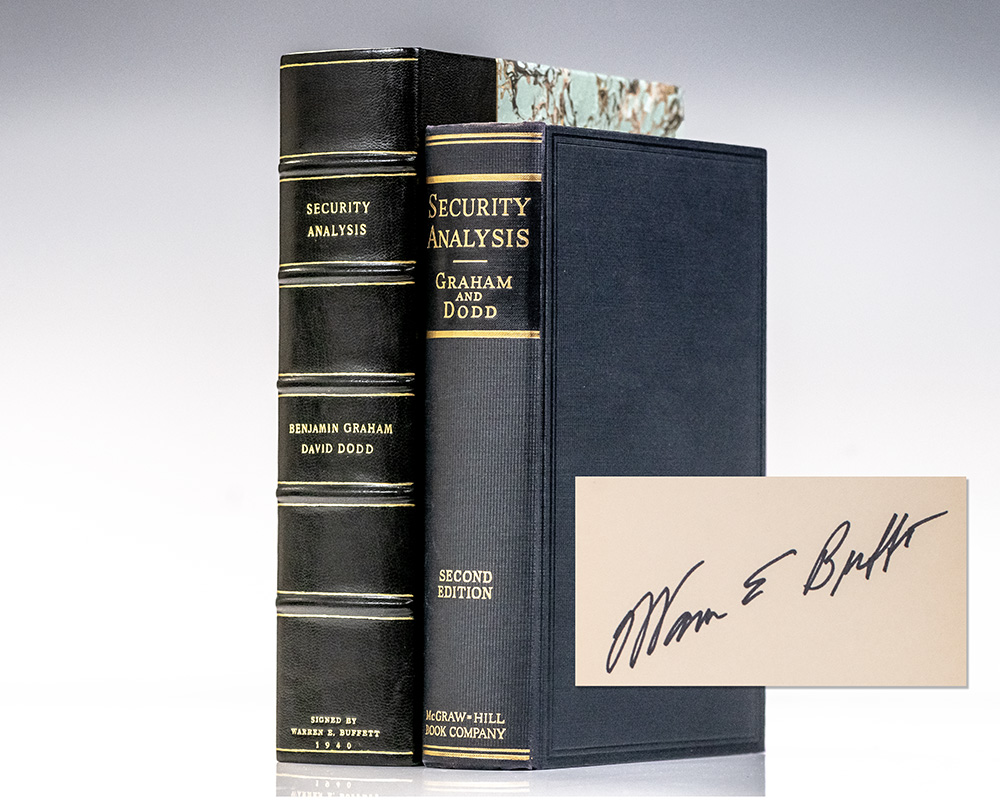

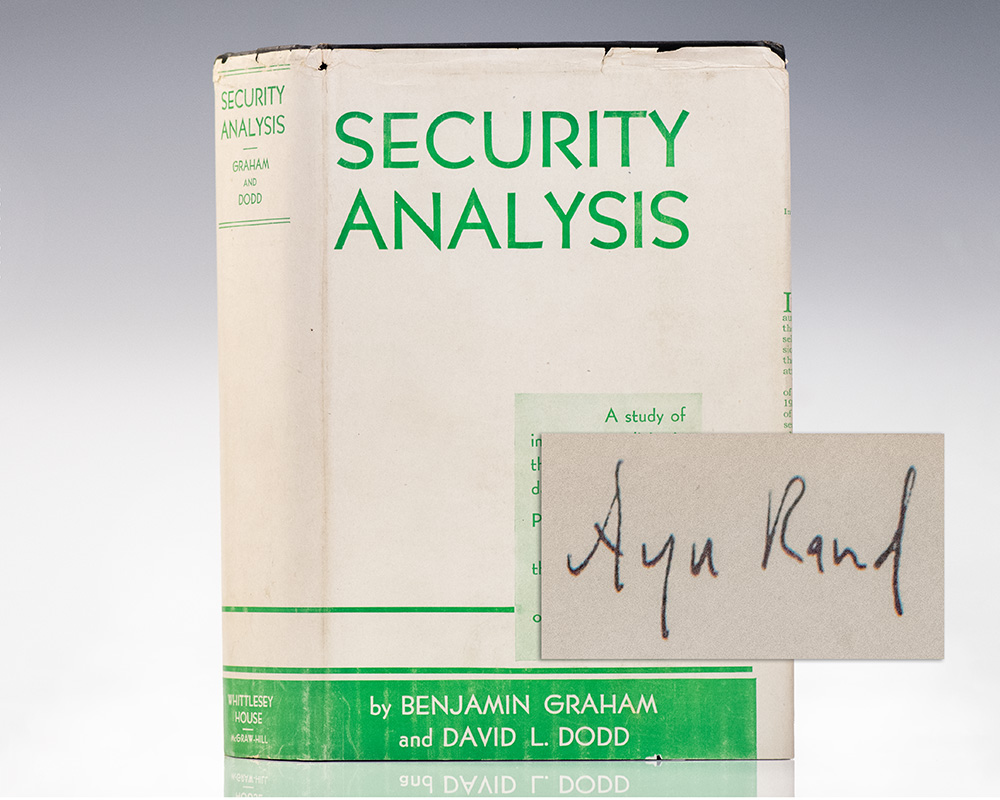

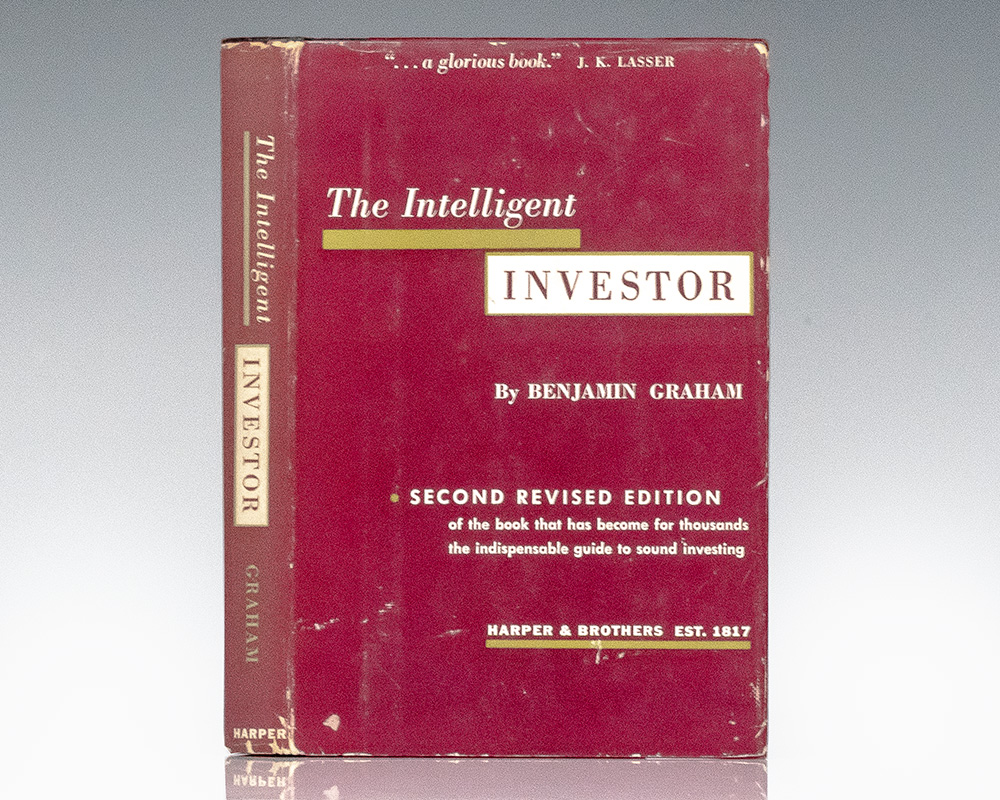

First edition, first printing with D-Y on the copyright page of the author's classic work. Octavo, original cloth. Presentation copy, inscribed by the author on the front free endpaper, "To Major Benj. H. Namm with the regards of Ben Graham May 1951." Near fine in a near fine dust jacket. Signed first editions are of the utmost scarcity, we have never seen or heard of another example.

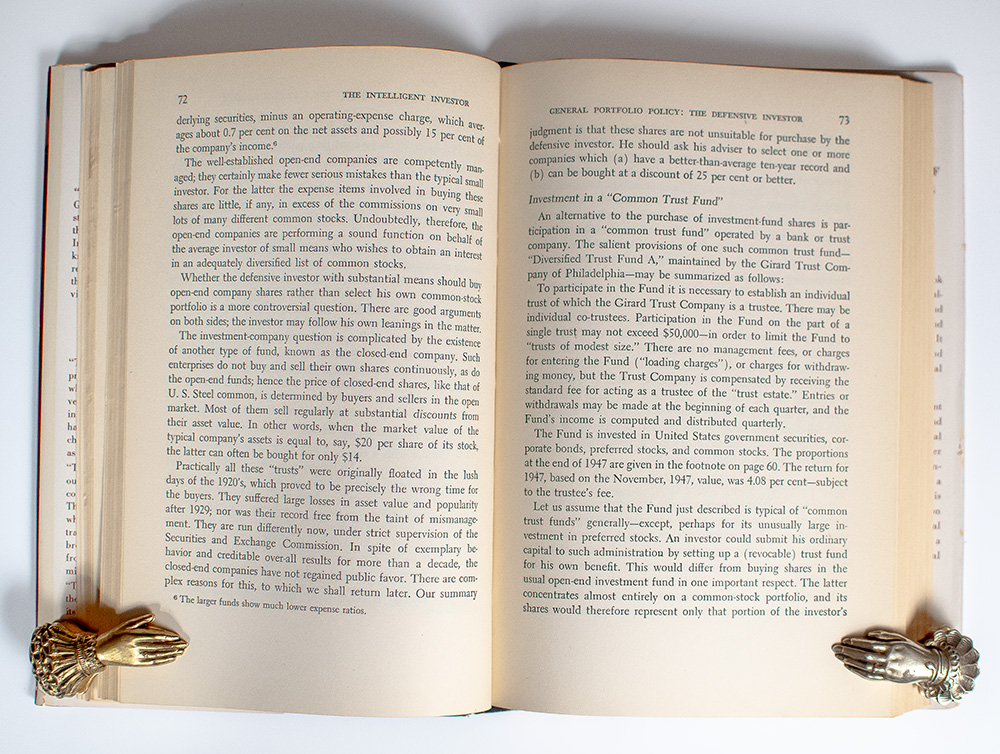

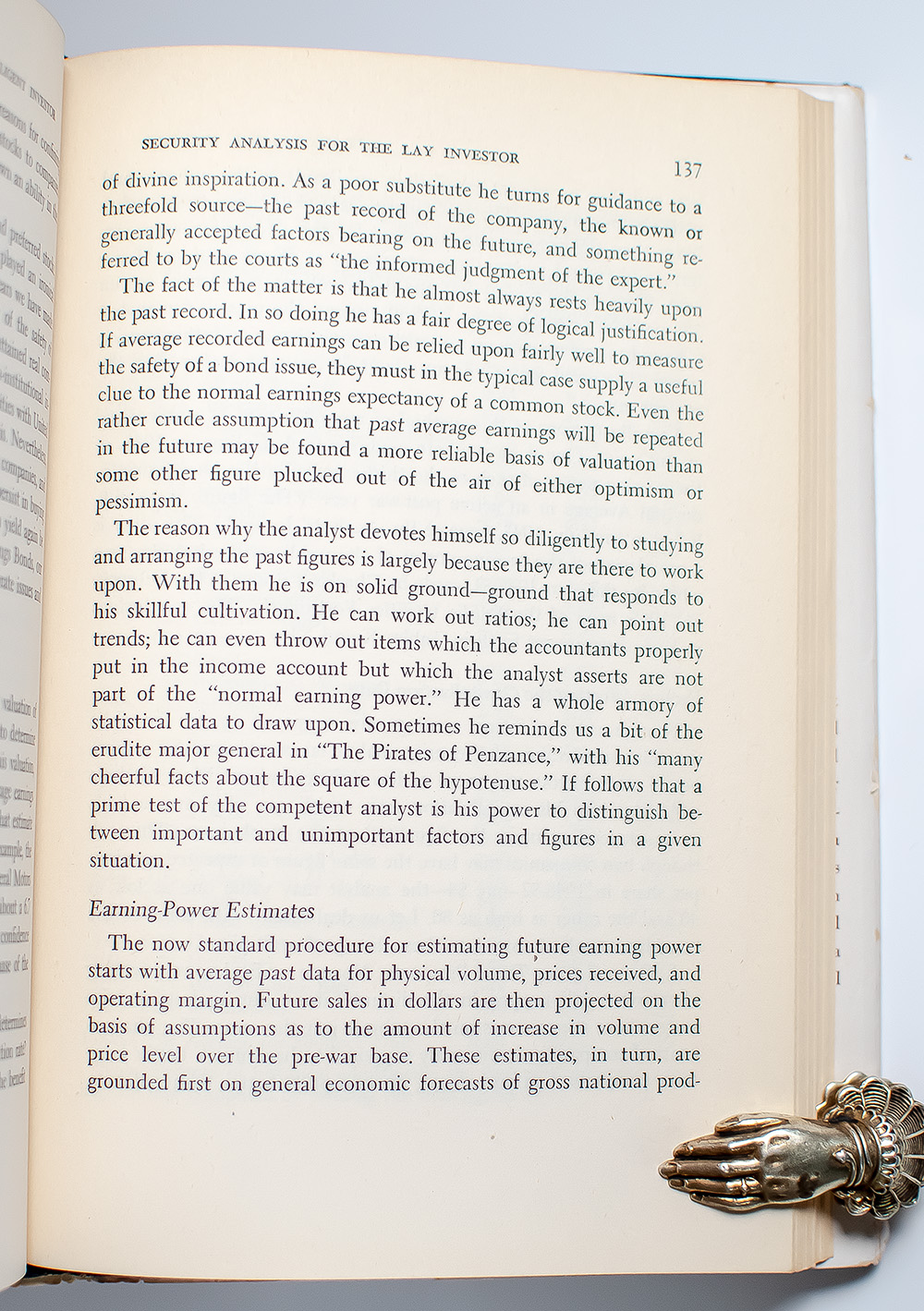

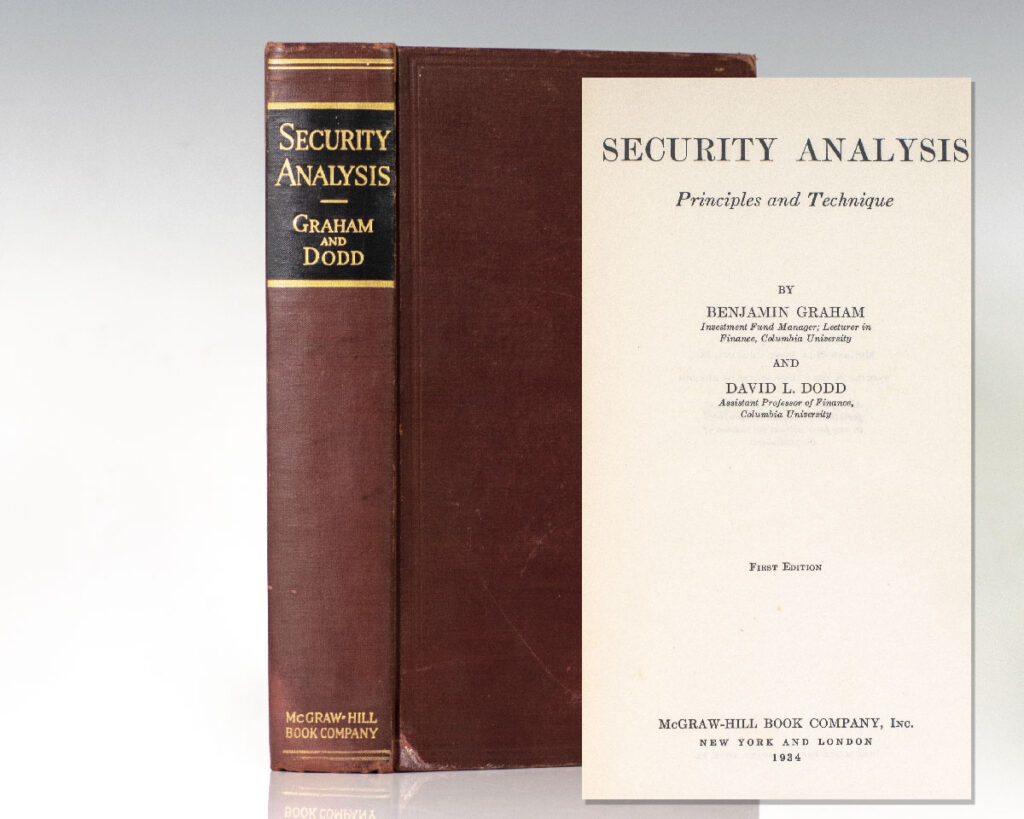

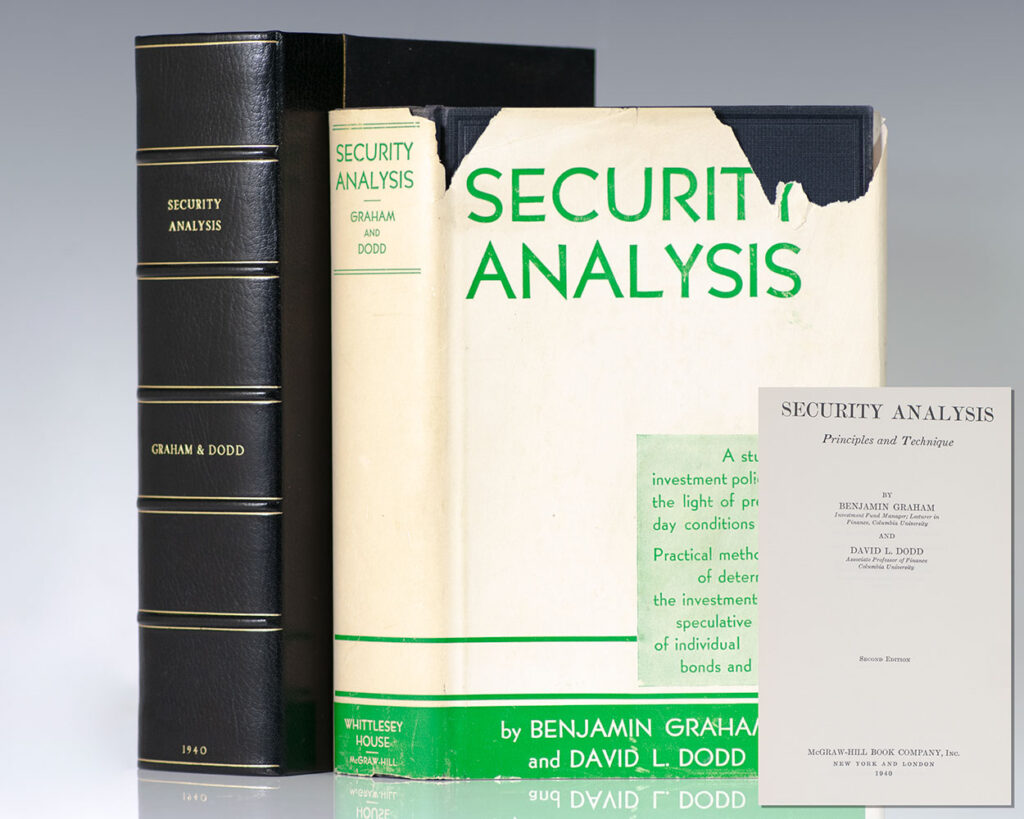

Since it was first published in 1949, Graham's Intelligent Investor has sold millions of copies and has been praised by such luminaries as Warren E. Buffet as "the best book on investing ever written." "Benjamin Graham was a seminal figure on Wall Street and is widely acknowledged to be the father of modern security analysis Security Analysis and The Intelligent Investor are still considered the ‘bibles’ for both individual investors and Wall Street professionals" (The Buffer Stock Project). Graham’s main investment approach outlined in The Intelligent Investor is that of value investing, an investment strategy that targets undervalued stocks of companies that have the capabilities as businesses to perform well in the long run. To determine value, investors use fundamental analysis. Mathematically, by multiplying forecasted earnings over a certain number of years times a capitalization factor of a company, value can be determined and then compared to the actual price of a stock. There are five factors that are included in determining the capitalization factor, which are long-term growth prospects, quality of management, financial strength and capital structure, dividend record, and current dividend rate. To understand these factors, value investors look at a company's financials, such as annual reports, cash flow statements and EBITDA, and company executives' forecasts and performance.

The Intelligent Investor.

$150,000.00

In Stock